Tradedoubler Interim Report January - September 2022

The third quarter July – September 2022

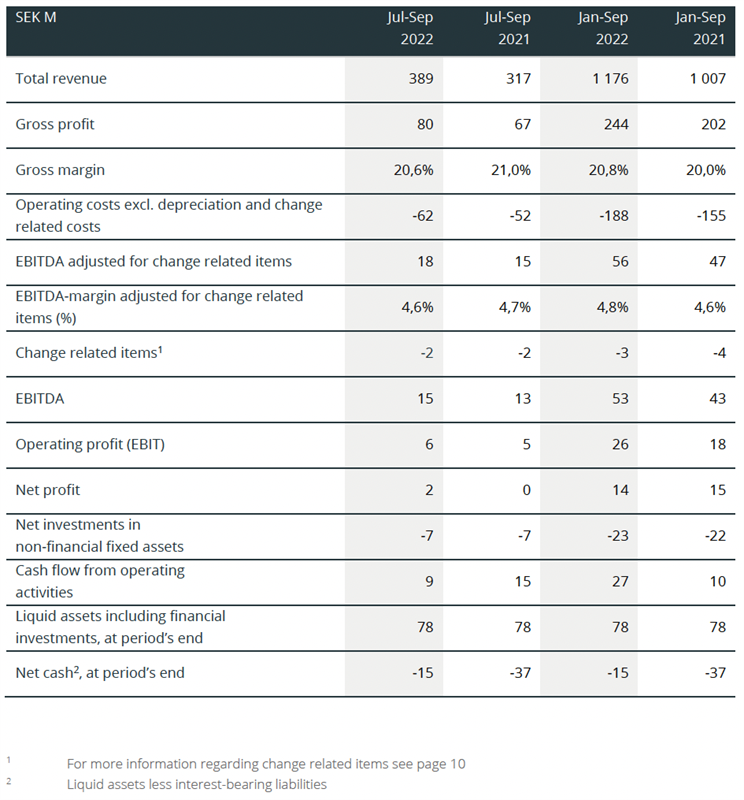

- Total revenue amounted to SEK 389 M (317) an increase of 23% or 19% adjusted for changes in exchange rates compared to the same period last year.

- Gross profit was SEK 80 M (67) an increase of 20% or 16% adjusted for changes in exchange rates. Gross margin was 20.6% (21.0).

- Operating costs excluding depreciation and adjusted for change related items were SEK 62 M (52), an increase of 20% or 17% adjusted for changes in exchange rates.

- EBITDA amounted to SEK 15 M (13). Adjusted for change related items, EBITDA was SEK 18 M (15).

- Investments in immaterial assets, mainly related to product development, were SEK 7 M (7).

- Cash flow from operating activities was SEK 9 M (15).

- Earnings per share, before and after dilution were SEK 0.05 (0.00)

The interim period January – September 2022

- Total revenue amounted to SEK 1,176 M (1,007), which is an increase compared to the same period last year by 17% or 13% adjusted for changes in exchange rates.

- Gross profit was SEK 244 M (202) an increase of 21% and 17% adjusted for changes in exchange rates. Gross margin excluding change related items was 20.8% (20.0).

- Operating costs excluding depreciation and adjusted for change related items were SEK 188 M (155), an increase of 21% or 18% adjusted for changes in exchange rates.

- EBITDA amounted to SEK 53 M (43). Adjusted for change related items, EBITDA was SEK 56 M (47).

- Investments in intangible assets, mainly related to product development, were SEK 23 M (22).

- Cash flow from operating activities was SEK 27 M (10) and the sum of cash and interest-bearing financial assets was SEK 78 M (78) at the end of the period. Net cash in end of the period was SEK -15 M (-37).

- Earnings per share, before and after dilution were SEK 0.32 (0.34).

- In the first quarter, Tradedoubler acquired approximately 30% of the shares in the online video shopping company Onbaz, a Swedish startup technology company. The purchase and partnership agreement signed with Onbaz will give the group access to technologies that complement and extend its current offering and products within the growing market of influencer marketing.

CEO Matthias Stadelmeyer’s comments

Tradedoubler´s business continued to grow at similar pace as in recent quarters and it actually even accelerated a bit more in the third quarter of 2022.

Total revenue in Q3 grew by 19%, gross profit by 16% and EBITDA was SEK 18 M, all figures on currency adjusted comparison and without change related items.

The reasons for our good results despite challenging macro-economic circumstances are Tradedoubler´s product portfolio and the expertise, spirit and energy of our teams in the markets.

Tradedoubler now offers a full suite of performance marketing solutions and technology with affiliate marketing as the core and the new offerings of Metapic, Grow and Appiness that have grown substantially during the year.

With this product portfolio we are able to connect our clients to relevant traffic sources and grow their business with our expertise and passion for creating meaningful results. We win relevant new clients while losing very few.

It is especially pleasing to see good growth rates in all Tradedoubler products and in all regions.

The increase of operational expenses compared to last year is linked to investments in our product platform and into the growth areas Metapic, Grow and Appiness.

In the coming quarters we will continue to further build on our market position and product portfolio. With these assets we will be able to continue our mission to grow the business of our clients and partners with meaningful results for all stakeholders. We enjoy a lot what we do and continue our mission with passion and courage. I look forward to your continued company on this journey.

Contact information

Matthias Stadelmeyer, President and CEO, telephone +46 8 405 08 00

Viktor Wågström, CFO, telephone +46 8 405 08 00

E-mail: [email protected]

Other information

This information is information that Tradedoubler AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Swedish Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 08.00 CET on 3 November 2022. Numerical data in brackets refers to the corresponding periods in 2021 unless otherwise stated. Rounding off differences may arise.