Freetrailer Group A/S quarterly report Q2 22/23

MAR

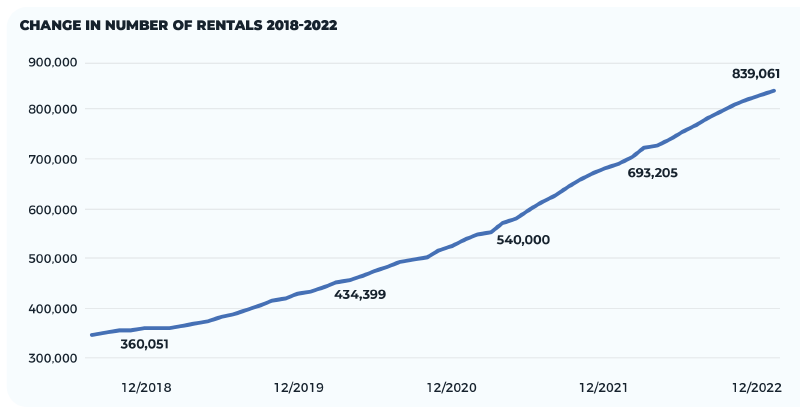

Freetrailer has delivered another quarter of growth, with the number of rentals increasing by 15% compared to Q2 21/22, and revenue growing by 26%.

Freetrailer Group A/S presents the Q2 quarterly report for the Group for the financial period 01 October 2022 - 31 December 2022.

Q2 GROUP KEY FIGURES IN 1.000 DKK (01 October 2022 - 31 December 2022)

(the corresponding period last year is indicated in brackets)

- Revenue 17,751.7 (14,093.3)

- EBITDA 1,537.8 (2,313.1)

- Profit before tax 1,148.5 (1,861.3)

- Profit after tax 830.7 (1,451.8)

- Equity 31,361.3 (22,140.1)

- EPS (Earnings Per Share) 0.09 (0.16)

- Equity ratio 65% (63%)

Rental growth in Q2 22/23 was 15% compared to Q2 21/22.

The number of rentals in Q2 22/23 amounted to a total of 202,438 compared to 176,383 in the same quarter last year.

Revenue in Q2 22/23 amounted to DKK 17.8 million compared to DKK 14.1 million in the same period last year, representing a growth of 26%.

The operating profit (EBITDA) for Q2 22/23 was DKK 1.5m compared to DKK 2.3m in the same period last year.

The EBITDA margin was thus 8.7% in Q2 22/23, compared to 16.4% in Q2 21/22.

Profit before tax for Q2 22/23 amounts to DKK 1.1m compared to DKK 1.9m in Q2 21/22

Freetrailer downgrades expectations

In light of the weak start to the year in terms of the roll-out of new rental products and a decline in the frequency of rentals in the first half of 22/23, Freetrailer is lowering its expectations for revenue and EBITDA. Freetrailer now expects revenue of between DKK 76 and 80 million, equivalent to growth of more than 21% compared to 21/22 (previously DKK 83 – 85 million).

EBITDA has been adjusted to DKK 10 – 13 million (previously DKK 16 – 17 million) as a result of extraordinary severance costs for the executive board, costs for new marketing initiatives, currency fluctuations in Norwegian and Swedish kroner, increased costs for strengthening the organization, and extra investments in the development of Freetrailers’ tech platform.

Interim CEO, Nicolai Frisch Erichsen comments on the quarterly report:

"Freetrailer has a clear growth strategy and now finds itself in a situation where business and financial results offer a good starting point for increasing investments in expansion. Freetrailer has a high level of liquidity with a cash balance of just over DKK 19 million which will now be invested in future growth in order to create long-term value for investors."