Sista chansen att teckna i ett Nano Tech-bolag som står inför tillväxt

Polymer Factory Sweden is a top-performing deep-tech company and leader within the field of research and commercialization of dendritic nanotechnology. Vaccines and anticancer drugs are prime examples of how the implementation of dendritic nanotechnology can result in more potent pharmaceuticals. The application of dendritic nanotechnology in pharmaceuticals is known to enhance the efficacy of the active ingredient.

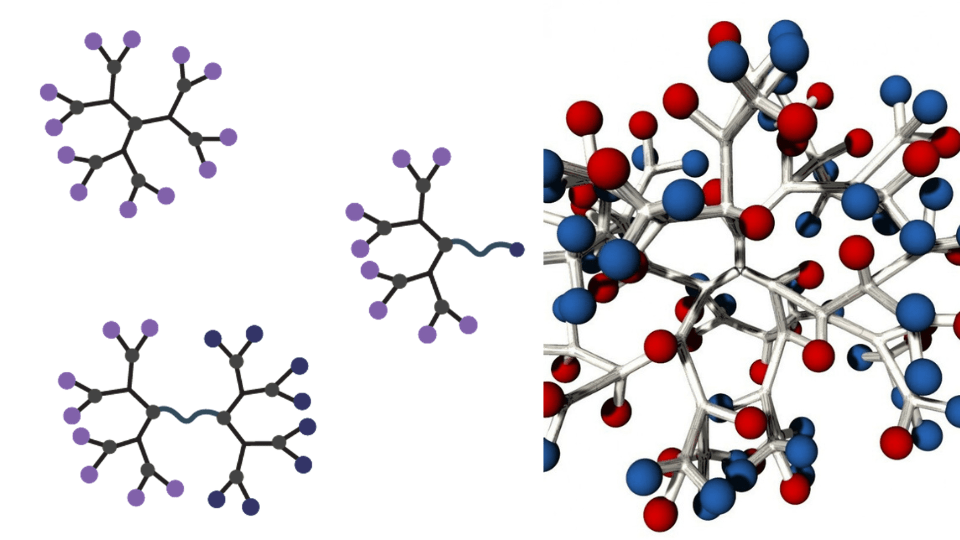

Founded in 2006 by a group of professors at KTH Royal Institute of Technology in Stockholm, Sweden, Polymer Factory specializes in providing products that can be tailored to meet the unique needs of its customers. Dendritic materials which the Company develops can be seen as a sort of tree, the unique architecture forming dendritic materials and providing them with their own structure, enables the material to function with an encapsulating or targeting effect in a broad range of scenarios to perform a specific task.

Polymer Factory is currently strengthening its balance sheet through a rights issue, which will contribute with a maximum of SEK 8.8m before issuing costs. The strengthened cash position will enable Polymer Factory to invest more capital in its sales organization and accelerate the research of dendritic nanotechnology, which will be the driving force behind developing the Company’s current products. Given that the rights issue is fully subscribed, and the Company's investment plan within research and sales, Polymer Factory is financed until Q2 2024.

Analyst Group Comments on the Rights Issue

"Polymer Factory is well-positioned in a promising market with a strong tailwind due to the high growth rate of the Company's target industries. Recently, the Company achieved the prestigious ISO 13485 certification, which is an internationally recognized quality assurance standard. As a result, Analyst Group is optimistic that Polymer Factory will continue to enhance its market position and make significant strides towards achieving even greater success. The ISO 13485 quality assurance has significant potential to act as a trigger for the Company, as the healthcare industry heavily relies on assurances before implementing new products.

Additionally, high market growth is expected to enable Polymer Factory to capitalize on its attractive business model. Through several sales channels, Polymer Factory has established cooperation’s with a diverse selection of customers, such as pharmaceutical manufacturers, medical- and biotechnology companies, research universities, and chemical companies. The diversified customer portfolio enables the Company to focus on penetrating the sector where the current market outlook indicates the most substantial demand for Polymer Factory's products.

Historically, the biggest challenge for Polymer Factory has been to get their products out on the market and increase brand awareness among customers who crave better solutions. With a stronger balance sheet, enabled via the rights issue, the Company will be geared up for an accelerated sales and marketing campaign during the coming year. With a pre-money valuation of SEK 11m, a favorable market trend, and several identified near-time triggers, which are expected to improve the Company's market position and, therefore, its revenue, is something that Analyst Group believes indicates that an investment in Polymer Factory invites to an attractive risk-reward if subscribing to the ongoing rights issue."

Analyst Groups Investment Thesis for Polymer Factory

Experience-led Research Provides a Competitive Edge in the Product Portfolio

According to the Board of Directors, the Company's product portfolio, containing over 300 types of dendritic materials, is the largest in the world. In addition, the product portfolio has attracted a diversified selection of customers, which underlines its importance.

A knowledgeable and driven in-house research team with skin in the game has resulted in an attractive product portfolio, which has been perfected over the last 17 years since Polymer Factory was founded. The quality of the products is underlined by ISO 13485, an internationally recognized quality standard received by the Company as late as Q4 2022. Polymer Factory's products are intended for use in the healthcare industry, where demand for high-quality products is critical. As a result, Analyst Group believes that quality assurances, such as ISO 13485, should not be underestimated, as it can serve as a potent catalyst for the Company.

An Attractive Business Model Allows for Capitalization on Increased Demand in Several Industries

Polymer Factory has established substantial collaborations with large companies through a flexible and extensive sales approach. Currently, Polymer Factory is maximizing its visibility through global and regional distributors of their products, complemented by Polymer Factory’s internal sales organization. Furthermore, Polymer Factory has developed an e-commerce platform from which the Company conducts direct sales to the Company’s business clientele. Thus far, the extensive and innovative sales approach has enabled Polymer Factory to obtain diverse customers, such as pharmaceutical manufacturers, medical- and biotechnology companies, research universities, and chemical companies. With a revenue of over USD 2,500m in 2022, Bruker is an example of a key customer that Polymer Factory can exponentially increase its sales towards as a result of increasing market demand for dendritic nanotechnology and the size of the customer.

Since Polymer Factory already has attracted customers whose future demand for their products has the potential to grow exponentially, Analyst Group does view the current business model as an instrumental tool for the Company in terms of the revenue growth it might generate. Furthermore, by having exposure to several different industries, Polymer Factory can deepen its collaboration with the industry that offers the most inviting business prospect concerning dendritic nanotechnology. Analyst Group views this as an advantage against competitors who lack a diverse customer base and are forced to “put all their eggs in fewer baskets”.

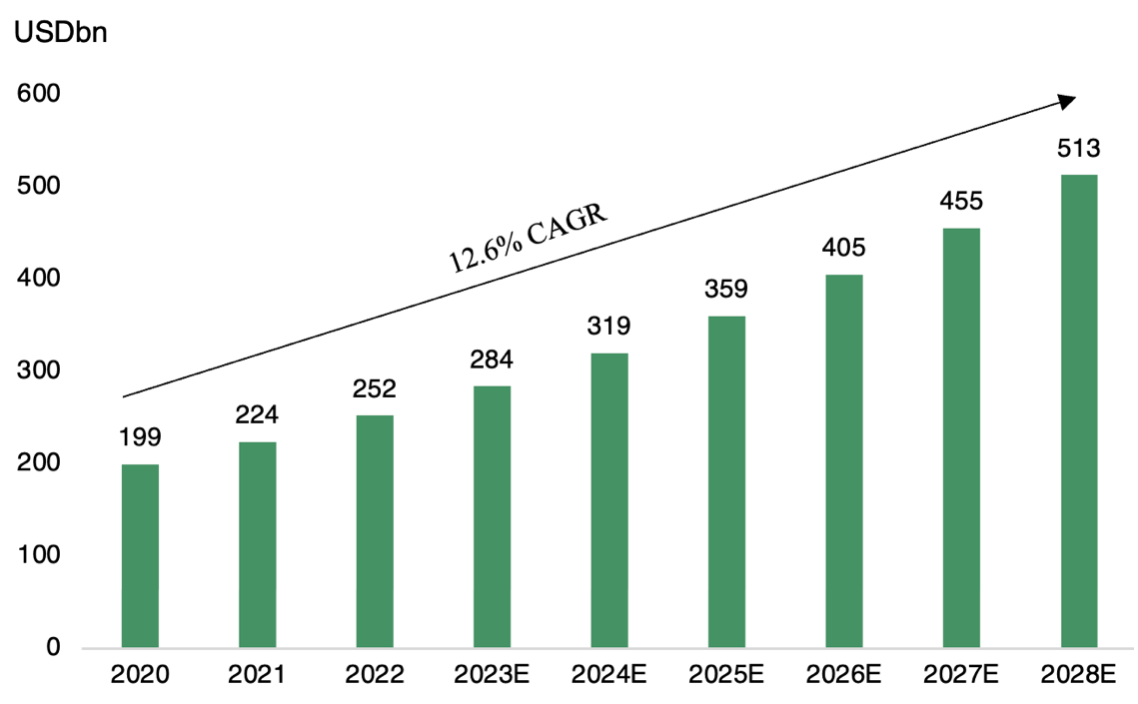

Strong Market Tailwind Provides Necessary Momentum to Scale the Organization

The market value of the nanomedicine market was estimated to be USD 199bn in 2020. Because of advanced research, which Polymer Factory has contributed to, new technologies implemented within nanomedicine are expected to be frequent. The need for more improved technologies within the sector is estimated to result in a strong yearly market growth rate of 12.6% (CAGR) from 2021 to 2028, equaling a market value of USD 513bn by the end of 2028. Polymer Factory acts on the dendrimer market, which is one of the nanotechnology pillars within the nanomedicine market, which is expected to grow with a similar CAGR. Analyst Group believes that Polymer Factory will be able to capitalize on the strong market growth due to higher demand for the competence that Polymer Factory possesses about dendrimers.

According to the Company, there are mainly three competitors in the dendritic materials market. The competition comprises of US-based Dendritech Inc, France-based COLCUM, and Australian-based Starpharma Holding Limited, which is the largest of the companies. Starpharma's market cap, which amounts to EUR 380m, is mainly a result of a successful launch of the clinically approved Vivagel® product line. Therefore, Starpharma provides a real-world example of the potential of the dendritic materials market. Analyst Group considers this as a proof of concept regarding that Polymer Factory operates in an industry where research breakthroughs and clinical approvals exponentially can grow the revenues and values of companies steeply.

Erbjudandet i sammandrag

- Teckningsperiod: 24 februari till 10 mars

- Teckningskurs: 1,6 kr

- Emissionsvolym: 8,8 MSEK

- Garanti- och teckningsåtagande: ca 70 %

- Värdering pre money: ca 11 MSEK

Finansiella instrument kan både öka och minska i värde. Det finns en risk att du inte får tillbaka de pengar du investerar.