Tradedoubler Interim Report January - June 2021

The second quarter April – June 2021

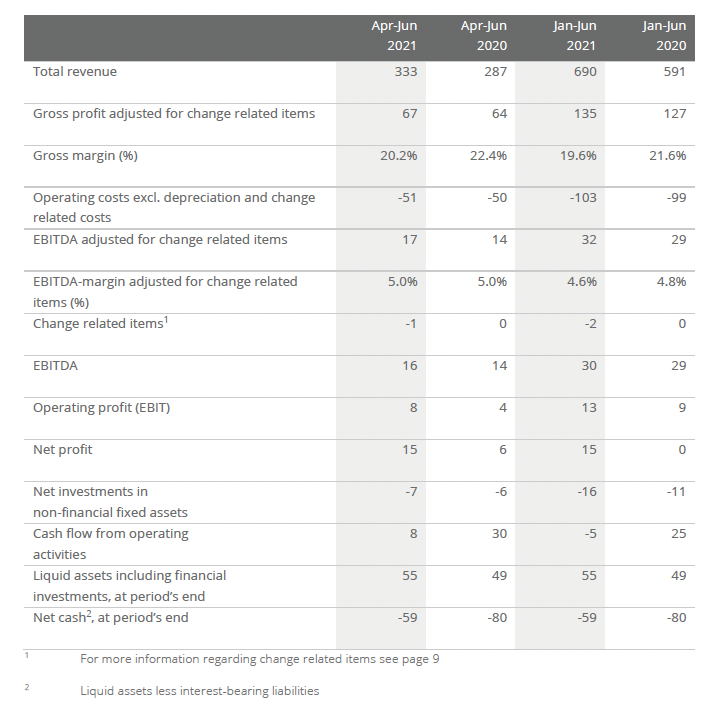

- Total revenue amounted to SEK 333 M (287) an increase of 16% or 21% adjusted for changes in exchange rates compared to the same period last year.

- Gross profit was SEK 67 M (64), an increase of 4% or 9% adjusted for changes in exchange rates. Gross margin was 20.2% (22.4).

- Operating costs excluding depreciation and change related items were SEK 51M (50), an increase of 1% or 4% adjusted for changes in exchange rates.

- EBITDA amounted to SEK 16 M (14). Adjusted for change related items, EBITDA was SEK 17 M (14).

- Investments in immaterial assets, mainly related to product development, were SEK 7 M (6).

- Cash flow from operating activities was SEK 8 M (30).

- Earnings per share, before and after dilution were SEK 0.34 (0.13).

The interim period January – June 2021

- Total revenue amounted to SEK 690 M (591), which is an increase compared to the same period last year by 17 or 22 % adjusted for changes in exchange rates.

- Gross profit was SEK 135 M (127), an increase of 6% and 11% adjusted for changes in exchange rates. Gross margin was 19.6% (21.6).

- Operating costs excluding depreciation and change related items were SEK 103 M (99), an increase of 4% or 8% adjusted for changes in exchange rates.

- EBITDA amounted to SEK 30 M (29). Adjusted for change related items, EBITDA was SEK 32 M (29).

- Investments in intangible assets, mainly related to product development, were SEK 14 M (11).

- Cash flow from operating activities was SEK -5 M (25) and the sum of cash and interest-bearing financial assets was SEK 55 M (49) at the end of the interim period. Net cash in the interim period decreased by SEK -29 M to SEK -59 (-80) M.

- Earnings per share, before and after dilution were SEK 0.33 (0.01).

- In 2016 Tradedoubler acquired a minority stake in DynAdmic for a total amount of 1,2 MEUR. In June 2021 these shares were sold to Smart, a leading independent French adtech platform, for a total potential amount of 2 MEUR. Around 1,75 MEUR were received in July 2021 as an upfront payment and a possible earnout of 0,25 MEUR depends on future results of the company. This deal resulted in a gain of SEK 7.7 M for the interim period.

CEO Matthias Stadelmeyer’s comments

The second quarter 2021 was the first quarter with a like-for-like comparison of the business in covid-19 conditions. In Q2 2020 the pandemic hit Tradedoubler´s business with negative effects on revenue and a positive impact on EBITDA. The negative revenue effects relate mainly to a reduction of the travel vertical which formerly stood for around 20% of our revenues, the positive impact relates to lower costs through reduced recruitment of staff, shorter working hours and government support. In Q4 2020 and Q1 2021 we started to gain good traction in the business, but in covid-19 / non-covid-19 comparisons.

Now the results of Q2 2021 show a continued positive business momentum on revenue, gross profit and EBITDA in this changed scenario as well. Adjusted for currency effects revenue grew by 21% and gross profit by 9% while EBITDA excluding change related items increased to SEK 17 M.

Similar to the first quarter 2021 all regions develop positively except of the UK, with the DACH region and the Nordics being the main growth drivers. The Southern Region had positive one-time effects on the business last year and has stable underlying revenues.

TD Grow, our new SaaS solution for SMB businesses and our influencer platform Metapic continued their good business momentum in Q2 as well and start to contribute to our revenue in a more prominent way.

In the industry verticals travel is growing again compared to Q2 last year, but on low levels and still far away from previous levels. All other verticals are stable with their usual seasonality.

The margin of our business is with 20,2% still lower as last year, but slightly increased compared to Q1. The reason for this are mainly additional budgets from larger clients whom we have expanded our business with during the last 12 months. The slight increase of the margin in Q2 is explained by seasonality as clients spend less media budgets in Q2 and Q3.

Operating costs cost are higher than previous year as we continue to investment in our staff and as well invest more into TD Grow and Metapic. We close the quarter with 251 employees compared to 226 in the comparison period, which is the main reason for the higher cost level. EBITDA landed at 16 which is the highest Q2 result in many years.

We continue our mission to grow the business of our clients and partners in the best possible way and create meaningful results for all stakeholders. We do that with passion and courage, and I look forward to your company on this journey.

Contact information

Matthias Stadelmeyer, President and CEO, telephone +46 8 405 08 00

Viktor Wågström, CFO, telephone +46 8 405 08 00

E-mail: [email protected]

Other information

This information is information that Tradedoubler AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Swedish Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 08.00 CET on 27 August 2021. Numerical data in brackets refers to the corresponding periods in 2020 unless otherwise stated. Rounding off differences may arise.